Featured

- Get link

- X

- Other Apps

Texas Surplus Lines Tax Calculator

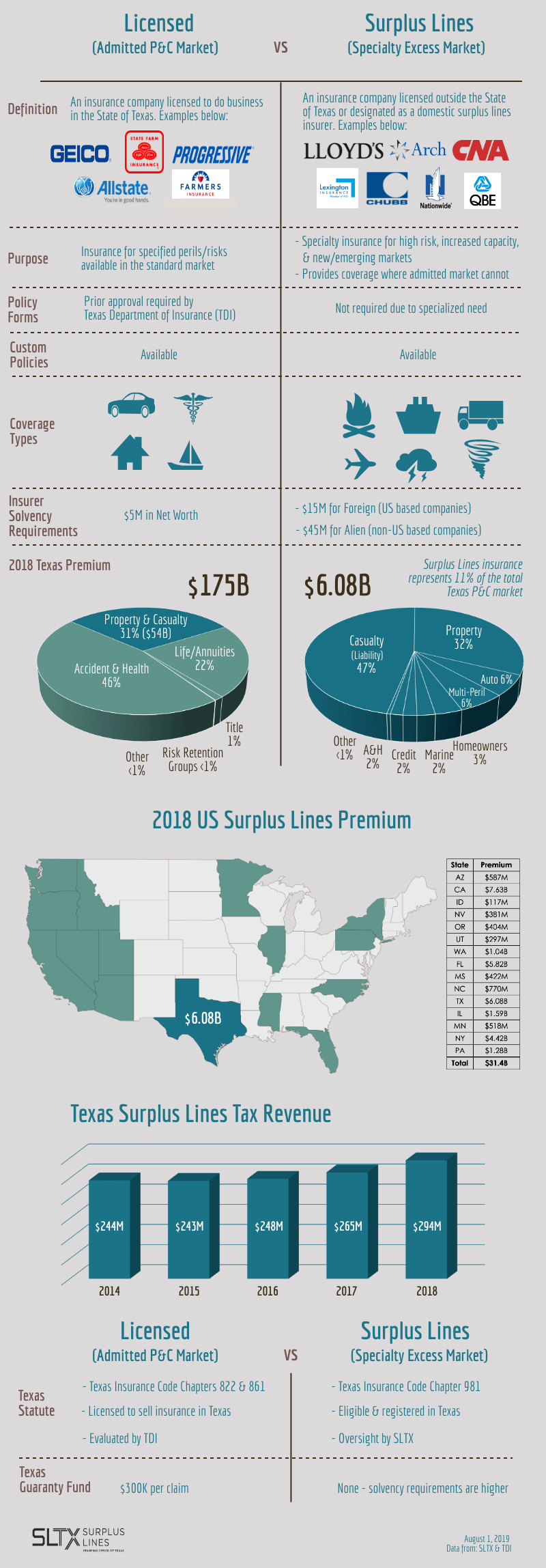

Texas Surplus Lines Tax Calculator. This tax is 3 percent of gross premiums and must be collected at the time of the delivery of the policy. Calculator for surplus line tax, fire marshal tax and stamping fee.

Centralized online location for all documents and affidavits. Who is responsible for this tax? Texas stamp guidelines and templates.

This Tool Is Provided Only As An Estimator, And Should Not Be Relied Upon For Tax Reporting Or Other Purposes.

The online calculator for interest and additions to tax (tax calculator) is designed to assist taxpayers in calculating interest and additions to tax due relating to west virginia tax liabilities. If you would like more information about our association and membership benefits, please contact us at your convenience: Texas does have an industrial insured exemption but adopted legislation in 2013 which aligns the exempt commercial purchaser definition of the nrra.

There Are Different Methods Or Approaches To Retrieving Tax Calculations Using Inscipher's Access Rest Api.

As part of developing ilsa’s latest online compliance tool, the surplus lines calculator & tax tool (catt), i had an opportunity to closely review the language of the stamps required by state regulators on surplus lines policies. Dba ilsa / ilsa, inc. Added by acts 2003, 78th leg., ch.

There's A Better Way To File Surplus Lines Taxes Welcome To Inscipher.

*please note, this estimator should not be used for. Sltx generates a monthly invoice/statement listing stamping fees due from brokers based on surplus lines policies processed. Let our surplus lines tax specialists file for you!

If You Can’t Find A Licensed Company To Sell You An Auto Liability Policy, Your Only Option Is The Texas Automobile Insurance Plan Association (Taipa).

The total amount of taxes and fees are displayed in the total box. A surplus lines agent holds taxes collected under this chapter in trust. Surplus lines companies sell mostly property and casualty polices.

The Tax & Stamping Fee Estimator Allows The User To Estimate Potential California Surplus Lines Taxes, As Well As The Stamping Fee, Based On Premium Entered.

Click save trace to save the trace as a text file. The 4.85% surplus lines tax is regulated by the texas comptroller of public accounts. To view the tax trace:

Comments

Post a Comment